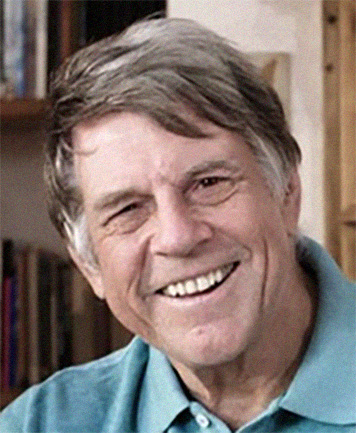

COLLINS, Damian

ISBN 978-1-923156-82-1

PAPERBACK

Property Investing Roadmap

How to build an income from property for life

Residential or commercial? Renovate or redevelop? Australians enjoy a feast of options when it comes to the nation’s favourite investment – property. But while most people only achieve one investment property, you can take your wealth to far greater heights using the right strategies.

In Property Investing Roadmap – How to build an income from property for life, Damian Collins, one of Australia’s most respected property experts, guides you through the spectrum of property-related choices, from how to buy your first rental property through to sophisticated strategies such as leveraging equity, property development, and diversifying a portfolio through commercial property.

Inside you’ll discover:

- Why you need to invest

- Signs that a property and location have growth potential

- Strategies to manage cash flow as a property investor

- How to build a team of experts to guide you on your property journey

- Why the time to take action is now

- How to complete a successful development project

- Why it makes sense to start with residential and end with commercial property

About the Author

A professional property investor for over 30 years, Damian Collins left his career as a Chartered Accountant to build a multi-million dollar personal property portfolio. As founder and Managing Director of residential property investment advisory, Momentum Wealth, and Chairman of property funds management company Westbridge Funds Management, Damian has championed opportunities for all Australians to reap the rewards of property investing. A former President of the Real Estate Institute of WA, Damian is regularly sought-after for commentary in media outlets as diverse as the Australian Financial Review, Australian Property Investor and Money magazine.